More than 200 Saskatchewan companies provide their employees the option to affordably keep their investment dollars at home with the SaskWorks Payroll Investment Plan.

Payroll Investment Plan Documents

Payroll Remittance Template

Payroll Deduction Calculator

Payroll Tax Credit Worksheet

Advisor Process

The SaskWorks Payroll Investment Plan (PIP) is a simple, tax efficient and effective way for employees to build their retirement savings. From a financial advisors perspective, the program is a value-added service that may be offered independently or as a component of a group benefits plan.

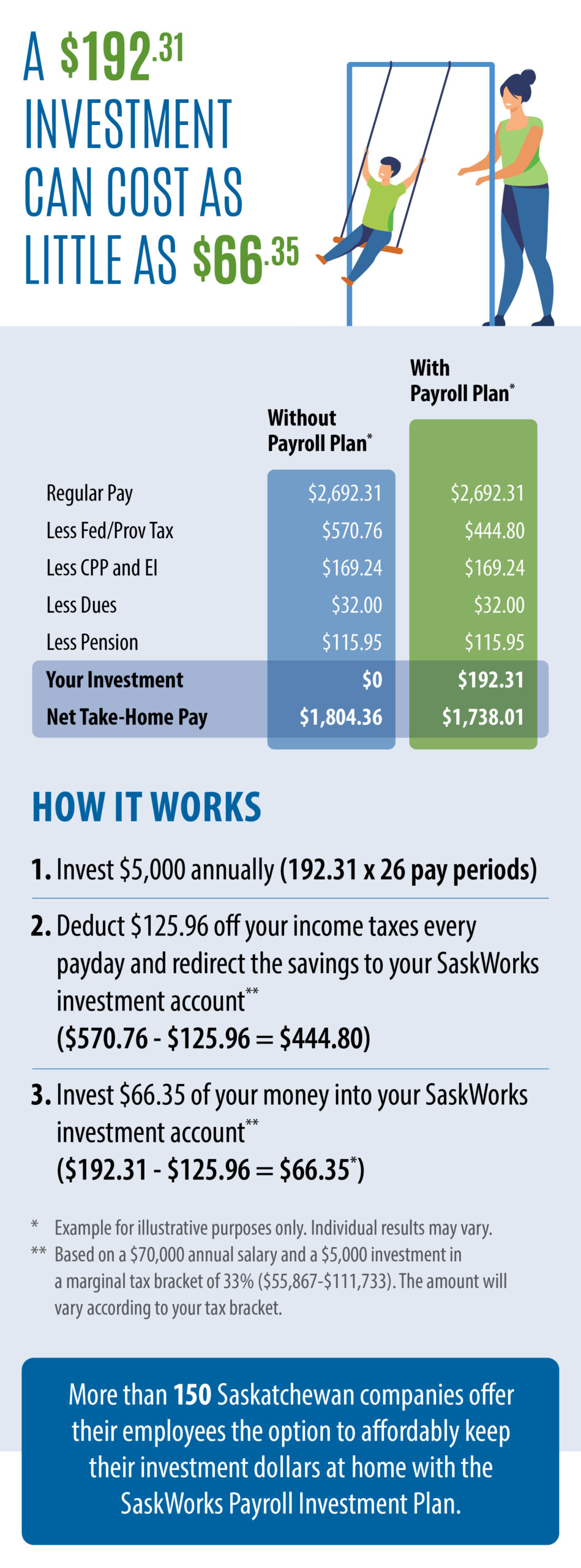

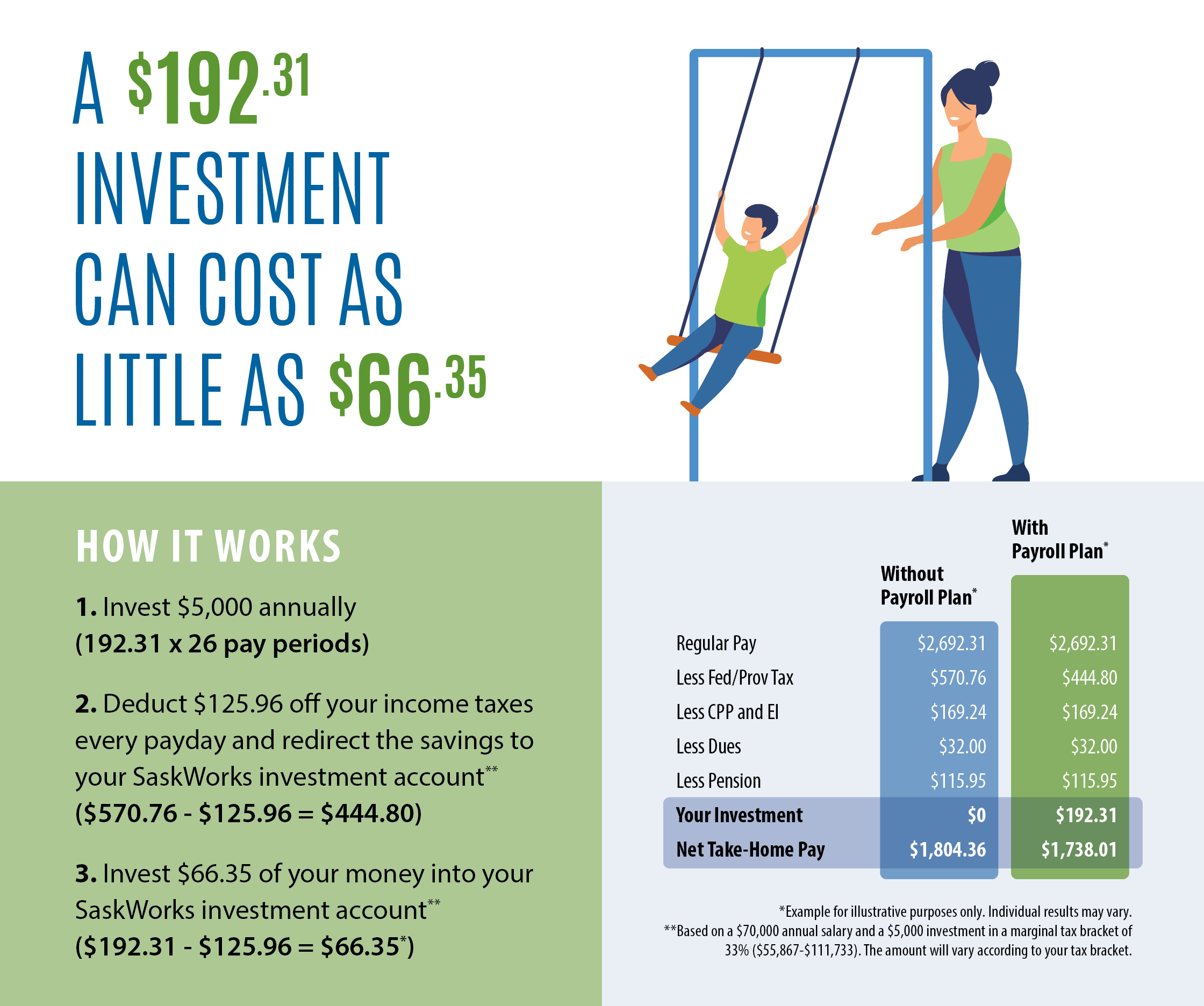

The Payroll Investment Plan allows employees to make direct contributions to their SaskWorks investment each pay-period. The 32.5% combined tax credit and the RRSP tax deferral are received at source that is, deducted from the income tax paid each pay period so employees will only see a minimal reduction in their net pay. At no cost to the employer and with a simple one-time set-up, the SaskWorks Payroll Investment Plan is an attractive retirement savings plan and effective employee retention strategy.

The Financial Advisor’s Role

The financial advisor plays an integral role in implementing and maintaining the payroll plan. It is the advisor’s responsibility to identify prospective companies and to ensure that the SaskWorks’ Payroll Investment Plan is not already in place within the organization. Although it is not required, SaskWorks prefers that the PIP be set up by the current advisor of record for the company’s group plan. Once prospective employers have been identified the advisor will play a major role in implementing the payroll investment plan. This process is outlined in detail below in order to aid the advisor in the set up and maintenance of the plan.

During the enrolment phase, the advisor will meet with interested employees to determine how an investment in the SaskWorks Venture Fund will fit within their individual savings strategy. With the employee, the advisor will use SaskWorks’ payroll deduction calculator to determine an optimal contribution amount and the tax deductions associated with it. The advisor is also responsible for providing the employee with the required disclosure materials as per compliance regulations (i.e. prospectus).

After the initial setup, the advisor is responsible for regular KYC updates as required by compliance. The advisor must be available to assist the shareholder with any changes to their contributions, including increasing, reducing, or ceasing contributions, and to address any problems or concerns the shareholder may have.

On an ongoing basis, the advisor must ensure that all payroll investment plan materials are kept current and in good supply with the employers to which they have introduced the program. SaskWorks, through the co-op marketing program, will work with the advisor to share the costs of marketing initiatives and materials.

Please note: employees are not obligated to work with any particular advisor. An employee may choose to sign up for the plan through an investment advisor of their choice. Likewise, if an advisor’s client is employed at an organization where the PIP is in place, he/she may enrol the client in the plan.

PIP Process

SaskWorks has prepared the following procedural guideline to ensure that the implementation of the plan is completed efficiently and with favorable results. The advisor will proceed with the following actions:

- Contact SaskWorks to determine:

- If the prospective company has an active payroll investment plan, and;

- If, to the knowledge of SaskWorks, the prospective company has been recently contacted regarding the plan.

- Determine the following before attempting to implement the plan:

- If the prospective company has a group plan, and if so, who administers it;

- If the company is unionized or non-unionized;

- The most appropriate point of entry (union or management?), and;

- Contact the employer, union or both and set up a meeting to obtain approval for the implementation of the Payroll Investment Plan. If it has been determined that the union is the primary point of contact, the union will be responsible for arranging a meeting with management to request the program’s implementation.

- When the employer agrees to proceed with the plan, the advisor, management and union (if applicable) must establish a start date and marketing strategy.

- Obtain the contact information of representatives from the company’s Human Resources department and Accounting/Payroll department and forward this information to SaskWorks.

- Market the plan :

- The advisor, employer, union (if applicable) and SaskWorks will create a marketing strategy that could include a mail drop to all employees, pay stub inserts, emails, intranet postings, etc.

- Posters, brochures and other marketing materials are available from SaskWorks to be posted in the workplace by the advisor.

- SaskWorks is available to present to prospective plan participants on an as needed basis at info nights, lunch and learn seminars, etc. SaskWorks, through the co-op marketing plan, will reimburse up to 50% of the costs associated with any informational events.

- If the workplace is unionized the union may be able to help market the PIP through union emails, newsletters, etc.

- The advisor will be responsible for the mailing of promotional pieces, planning of events, and identifying any other vehicles for the dissemination of informational materials.

- Provide management with the SaskWorks Payroll Investment Plan Employer Information Document.

- Meet with employees to begin enrolment in the PIP program. Employees are not obligated to invest with any advisor; even if that advisor is the advisor of record for their group plan.

- Submit all completed forms to Prometa Fund Support Services (SaskWorks’ back office), including:

- Subscription form, and;

- Payroll authorization form

SaskWorks’ back office and the employer will then take the following actions:

- Prometa will fax necessary paperwork and deduction information to the employer contact.

- The employer’s payroll department will set up a cheque or EFT process along with a spreadsheet for reporting the shareholders names, contribution amounts, and SIN’s to be remitted on a monthly basis.

How to Sign Up an Individual

During the scheduled meeting with their advisor, the interested employee will complete the enrolment process. It is the advisor’s responsibility to ensure the potential shareholder fully understands the risks and benefits associated with the fund.

The shareholder will meet with the advisor who will complete the Subscription form for them. When completing the form, the advisor should note the following:

- Choose the account type (LIRA not eligible for PIP).

- Under Source of Funds choose Payroll Deduction.

- Use the payroll calculator on saskworks.ca to determine the individual’s contribution amount.

- Determine the allocation of funds to each share class.

- Client signs form ensuring information is accurate.

- Advisor signs and indicates dealer/rep code.

The advisor must also complete the Payroll Authorization Form for the shareholder, and note the following:

- Transfer the employee contact information from the Subscription form.

- Fill in the employer information area; contact SaskWorks if assistance is required.

- For a new enrolee, complete the New Plan area.

- Transfer the contribution info from the Subscription form.

- Ensure the effective date is entered and correct.

- If the employee already holds an account or shares with SaskWorks, enter the existing account number.

The employee and the advisor both sign the Payroll Authorization form. The completed forms need to be mailed or faxed to SaskWorks’ back office at the address or fax number indicated on the top of the forms.

For changes to an existing plan, the advisor and employee will fill in the “Changes to Contributions or Cease Plan” section of the Payroll Authorization Form. A subscription form is not needed when changing an existing plan. The advisor simply needs to check the appropriate box and provide the necessary information.

All processed PIP investments are held off-book (also known as client held or self-directed investments). When investments are held in this format, the client is the owner of the investment versus the advisors firm holding the investments on behalf of the investor. Processing the Payroll trades as off-book allows the Fund to identify and report shareholder information more effectively. It also allows the Fund to waive the client’s $35.00 initial setup fee.

PIP Maintenance

Once the SaskWorks Payroll Investment Plan has been implemented within a workplace, if it is maintained properly it is a program that will benefit the financial advisor for years to come. Past experience has shown that employee turnover within a business will cause the amount of employees participating in the PIP to decrease over time. With that in mind we ask that advisors take the following actions to maintain the PIP program:

- Monitor the employees enroled in the PIP to identify and address participation trends.

- Monitor the companies themselves in order to capitalize on any opportunities to expand the PIP program within those companies (i.e. expansions, mergers, etc.).

- Contact the “Employer Contact” at least semi-annually to ensure the program is running smoothly, the employer contact has not changed, and to update marketing materials within the workplace.

- If employee participation is decreasing within the company, organize new information sessions to revitalize the company. It is recommended that advisors host an Info Night at least bi-annually. SaskWorks will co-op any costs associated with PIP presentations or info nights.

It is not necessary for a financial advisor to be in constant contact with the employer, merely to ensure that the program is running smoothly and that new additions to the company are aware of the program and capable of enroling.

SaskWorks maintains an independent payroll consultant who is available to support employers who are looking to implement the program.

For more information regarding the SaskWorks Payroll Investment Plan, please contact:

Austin Bentz

Email: austinbentz@pfm.ca

Telephone: 306-533-9170

All payroll remittances, subscription forms and payroll authorization forms should be mailed or faxed to:

SaskWorks Venture Fund

c/o Prometa Fund Support Services Inc.

220 – 155 Carlton Street, Winnipeg, MB R3C 3H8

Phone: 1-866-992-7696

Fax: 1-855-766-8020