More than 200 Saskatchewan companies provide their employees the option to affordably keep their investment dollars at home with the SaskWorks Payroll Investment Plan.

The SaskWorks Venture Fund’s Payroll Investment Plan is a simple, tax-efficient way for your employees to save for retirement. Since SaskWorks’ inception in 2001, the Fund has provided a unique opportunity for Saskatchewan residents to keep their investment dollars at home. SaskWorks invests in small- and medium-sized Saskatchewan businesses, allowing your employees to add a piece of our province to their portfolio while stimulating the local economy and creating jobs in Saskatchewan.

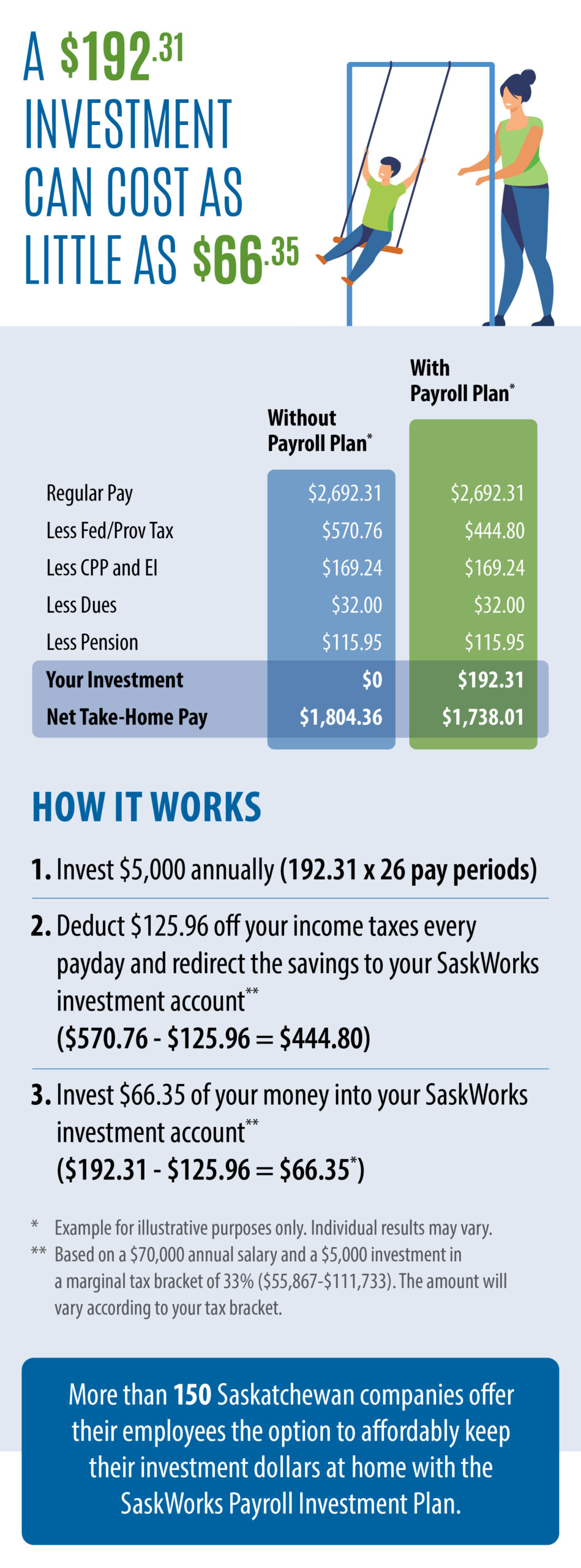

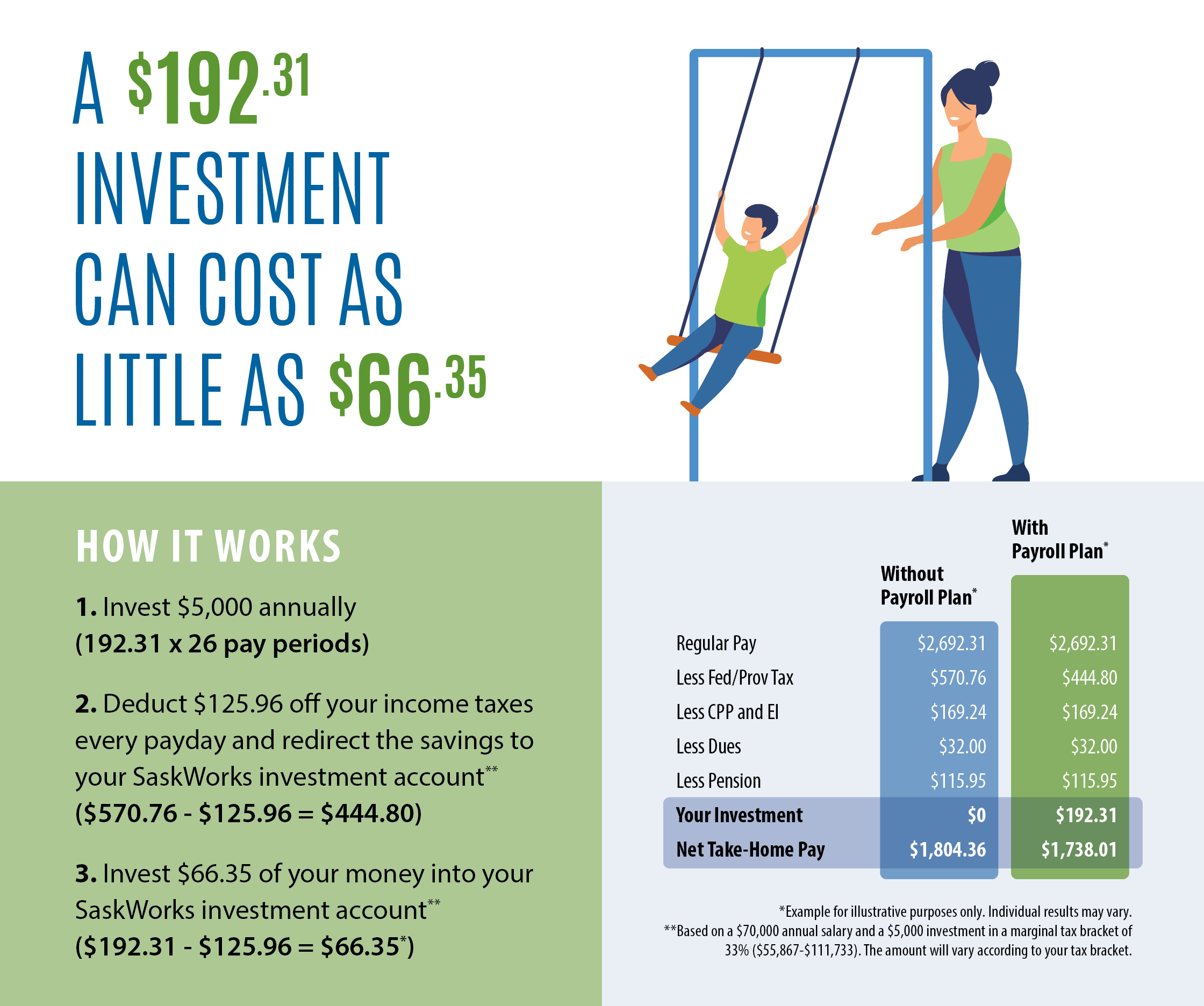

Under Saskatchewan’s Income Tax legislation, investors in SaskWorks are eligible to receive a 15% federal and 17.5% provincial tax credit on an annual investment of up to $5,000.00. Your employees will also benefit from an RSP tax deferral if the investment is held in a registered account.

The Payroll Investment Plan allows employees to make direct contributions to their SaskWorks investment each pay-period. The 32.5% combined tax credit is received at source – that is, deducted from the income tax paid each pay period – so your employees will only see a minimal reduction in their net pay. At no cost to you and with a simple set-up, the SaskWorks Payroll Investment Plan is an attractive retirement savings plan for your company’s valued staff.

Getting Started

Are you interested in implementing this plan into your workplace but unsure how to explain it? Don’t stress. A SaskWorks representative is happy to come to your place of business, or location of preference, and provide a catered lunch-and-learn presentation on the SaskWorks Payroll Investment Plan. Sign up now to get started or to learn more.

The Employer’s Role

The employer plays an important part in the PIP process. Once the plan has been implemented, the employer must receive and process all faxed copies of the completed Payroll Authorization forms from SaskWorks’ back office. They will then establish the deduction code and amounts for the employee in their payroll system and apply them to the employee’s paycheques.

If the payroll is outsourced, the employer needs to ensure the above information is provided to the payroll vendor. They must also ensure that the vendor provides SaskWorks with the proper remittance and reporting spreadsheet.

SaskWorks retains an external payroll administration consultant to provide assistance in the initial set-up where required.

PIP Process

SaskWorks’ has developed the following procedural guideline to simplify the implementation of the Payroll

Investment Plan for participating employers.

- The employer will designate representatives from the Human Resources and Accounting/Payroll Administration departments to represent the organization to the investment advisor, SaskWorks and the company’s employees.

- The company representative from the HR department will be responsible for:

- Communicating any changes in retirement savings plan details to employees (why is the company making the change, etc.);

- Aiding the financial advisor and SaskWorks in distributing informational materials to employees (company email, helping to organize information nights, etc.);

- Being present at any informational sessions as a representative from the company in order to answer any company-specific questions;

- Including a current SaskWorks Payroll Investment Plan brochure with the employment package that is provided to new hires; and

- Contacting the investment advisor or SaskWorks whenever SaskWorks marketing materials need to be re-stocked.

- SaskWorks and/or the investment advisor of record will contact the HR representative semi-annually to provide program updates, address concerns and replenish marketing materials (brochures, posters, etc.).

- The company representative from the accounting/payroll department will be responsible for:

- The set up of the PIP in the company’s payroll software;

- Set up instructions for common accounting/payroll software is available upon request.

- In the event that the basic set-up instructions do not apply to your payroll system, SaskWorks retains an external payroll consultant which will be made available to your company in order to facilitate the set up process.

- Setting up an electronic funds transfer (EFT) or cheque remittance process in order to remit the company’s employee’s contributions at least monthly to Prometa (SaskWorks’ back office; contact information below);

- Remitting a spreadsheet to Prometa (SaskWorks’ back office; contact information below) containing employee name, SIN, and contribution amount for all employees contributing to the plan along with the EFT or cheque; and

- Processing all payroll authorization forms that are sent from Prometa to the employer regarding new contributors, contribution changes or cessation of plan participation. An example of the payroll authorization form is included with this document.

Payroll Investment Plan: Additional Information

Payroll Investment Plan Brochure

Payroll Investment Plan Supplementary Information

Payroll Deduction Calculator

Payroll Remittance Template

Payroll Tax Credit Worksheet

Sage 50 – SaskWorks Deduction Setup Instructions

QuickBooks – SaskWorks Deduction Setup Instructions

For more information regarding the SaskWorks Payroll Investment Plan, please contact:

Austin Bentz

Email: austinbentz@pfm.ca

Telephone: 306-533-9170

All payroll remittances, subscription forms, and payroll authorization forms should be mailed or faxed to:

SaskWorks Venture Fund

c/o Prometa Fund Support Services Inc.

220-155 Carlton Street

Winnipeg, Manitoba R3C 3H8

Phone: 1-866-992-7696

Fax: 1-855-766-8020